Build A Info About What Is Shorting With Example

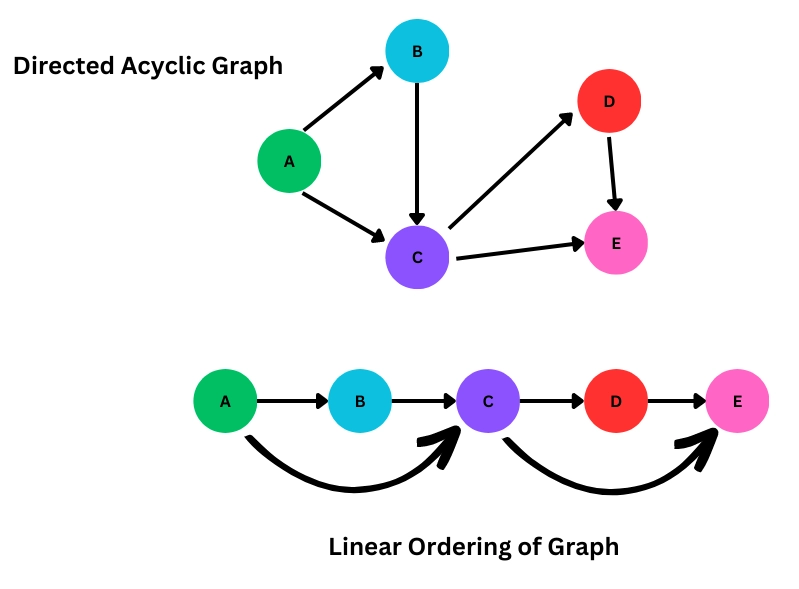

Sorting Algorithm

Unlocking the Mystery of Shorting

1. What Does 'Shorting' Really Mean?

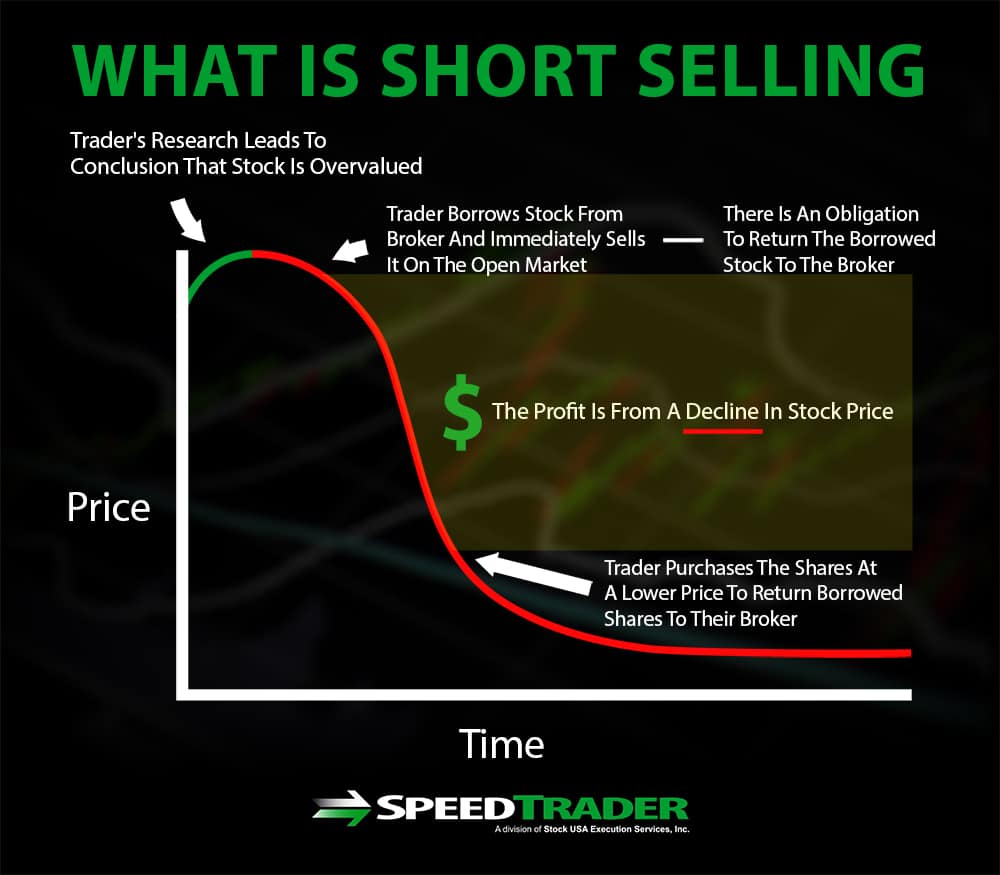

Ever heard someone say they're "shorting" a stock and wondered what on earth they're doing? Well, buckle up, because we're about to demystify it! Shorting, or short selling, is essentially betting that a stock (or any asset, really) is going to decrease in value. Think of it like predicting rain — you're positioning yourself to profit if the storm comes.

Instead of buying low and selling high (the traditional way), shorting involves borrowing shares you don't own and selling them. The idea is to buy those shares back later at a lower price, return them to the lender, and pocket the difference. Sounds simple, right? Like most things in finance, the devil's in the details.

The reason why it's called shorting is because you are borrowing something. You're essentially taking a "short" position on the stock, hoping its price will "fall short" of where it is now. So, if you think a company's stock is overvalued or headed for trouble, shorting allows you to potentially profit from that decline. It's like being a contrarian investor — going against the grain of popular opinion.

Think of it this way: your neighbor says Widgets Inc. is going to the moon. You, however, think Widgets Inc. is producing buggy widgets. You could borrow shares of Widgets Inc. from your broker and sell them. If the stock price drops because everyone realizes the widgets are buggy, you buy them back cheaper and return them to the broker. The difference is your profit! (Hopefully enough to buy your neighbor a nice apology gift...or not!).

An Example to Sink Your Teeth Into

2. Shorting in Action

Let's continue with our Widget Inc. scenario. Imagine the stock is trading at $50 per share. Convinced it's overpriced, you borrow 100 shares from your brokerage and immediately sell them for a cool $5,000. Now, you're holding $5,000, but you owe 100 shares of Widget Inc.

A few weeks later, news breaks that Widget Inc. is facing a massive recall due to faulty widget design. The stock plummets to $25 per share. Seeing your prediction come true (and smelling potential profit!), you buy back 100 shares for $2,500. You then return those shares to the brokerage, fulfilling your obligation.

Here's where the magic happens. You initially sold the shares for $5,000 and bought them back for $2,500. Your profit is $2,500 (before any fees or interest from the brokerage, of course!). You correctly anticipated the stock's decline and profited from it. Bravo!

But here's the catch: what if you were wrong? What if, instead of plummeting, Widget Inc. developed a revolutionary self-repairing widget and the stock soared to $100? You'd have to buy back those 100 shares for $10,000, resulting in a $5,000 loss. That's why shorting can be risky — your potential losses are theoretically unlimited because there's no limit to how high a stock price can go.

Topological Sorting Coding Ninjas

The Risks and Rewards

3. Weighing the Upsides and Downsides of Shorting

Shorting isn't for the faint of heart. It comes with a unique set of risks that every potential short seller needs to understand. Unlike buying a stock, where your maximum loss is limited to the amount you invested, shorting has theoretically unlimited risk. The stock price could rise indefinitely, forcing you to buy back the shares at increasingly higher prices.

Another risk is something called a "short squeeze." This happens when a stock that's heavily shorted suddenly starts to rise. Short sellers, fearing further losses, rush to buy back the shares, driving the price even higher. This can create a feedback loop that amplifies losses for those who are shorting the stock.

Despite the risks, shorting can be a valuable tool for sophisticated investors. It can be used to hedge against potential losses in other investments, or to profit from a declining market. It can also help to identify and expose overvalued companies, contributing to market efficiency.

However, it's crucial to have a solid understanding of the company you're shorting, as well as the broader market conditions. Thorough research and risk management are essential for successful short selling. Never short a stock based on rumors or hunches. Treat it like any other investment decision: do your homework! And maybe don't short your neighbor's favorite company unless you're prepared for some awkward backyard barbecues.

Shorting A Stock Your Essential Guide To Short Selling

Is Shorting Right for You?

4. Assessing Your Risk Tolerance and Knowledge

Before jumping into the world of short selling, take a good, hard look in the mirror and ask yourself: "Am I really ready for this?" Shorting is generally not recommended for beginner investors. It requires a deep understanding of market dynamics, risk management, and the specific companies you're targeting. Do you have the stomach to watch a stock you're shorting suddenly spike upwards, even if you ultimately believe it will decline?

Consider your risk tolerance. Are you comfortable with the possibility of significant losses? Can you handle the stress and uncertainty that comes with shorting? If you're the type of investor who prefers a slow and steady approach, shorting may not be the right fit for you. Stick to more conservative strategies.

Also, assess your knowledge of the company you're considering shorting. Do you understand its business model, its competitors, and the industry it operates in? Are you able to analyze its financial statements and identify potential weaknesses? A thorough understanding of the company is crucial for making informed short selling decisions.

If you're unsure whether shorting is right for you, consider seeking advice from a qualified financial advisor. They can help you assess your risk tolerance, evaluate your knowledge, and develop a strategy that's aligned with your financial goals. Remember, there's no shame in admitting that shorting is beyond your comfort zone. Plenty of other investment strategies can help you achieve your financial objectives.

Shorting Vs Short Selling

The Ethical Considerations of Shorting

5. A Debate Worth Having

Shorting sometimes gets a bad rap. Some critics argue that it's unethical because it profits from the misfortunes of others. They say that short sellers are essentially betting against companies and potentially contributing to their downfall. This is a valid perspective, and it's important to consider the ethical implications of short selling.

However, proponents of shorting argue that it plays a valuable role in the market. They say that short sellers help to identify and expose overvalued companies, preventing bubbles from forming and contributing to market efficiency. By shedding light on potential problems, short sellers can help to protect other investors from losses.

The truth is that there are valid arguments on both sides of the debate. Ultimately, whether or not shorting is ethical is a matter of personal opinion. It's important to consider the potential consequences of your actions and to make decisions that align with your own values.

Furthermore, short selling can expose fraud and mismanagement. By scrutinizing companies and betting against them when they see issues, short sellers can act as a check on corporate behavior and help to ensure that companies are held accountable. This can benefit the market as a whole by promoting transparency and integrity.

What Is Shortening In Baking? LoveCrafts

FAQ

6. Your Burning Questions Answered

Alright, let's tackle some frequently asked questions to solidify your understanding of shorting.

Q: What happens if the stock I'm shorting goes bankrupt?A: If the stock goes to zero, you profit! Your buyback price is zero. However, bankruptcy proceedings can get complicated, and you may still have to deal with legal issues and potential claims.

Q: What is a "margin call" in short selling?A: A margin call happens when the price of the stock you're shorting rises, and the value of your account falls below a certain level. Your broker will demand that you deposit more funds to cover potential losses. If you don't, they may forcibly buy back the shares, resulting in a loss for you.

Q: Can I short any stock?A: Not all stocks are available to short. Your broker needs to have shares available to borrow. Heavily shorted stocks can be harder to borrow and may come with higher borrowing fees.